Get More Bang for Your Buck: How Gas Cash Back Programs Can Help You Stretch Your Budget

Get More Bang for Your Buck: How Gas Cash Back Programs Can Help You Stretch Your Budget

With gas prices constantly on the rise, it's no surprise that many people are looking for ways to save money at the pump. One solution that has been gaining popularity is gas cash back programs. These programs offer consumers a chance to earn cash back on their gas purchases, allowing them to stretch their budgets further and get more bang for their buck. Whether you're a frequent commuter or simply looking to save money on your weekly fill-ups, gas cash back programs can be a great way to put a little extra money back in your pocket. In this article, we'll take a closer look at how these programs work and how you can start taking advantage of them today. So if you're ready to start saving money on gas, read on to learn more about gas cash back programs and how they can help you stretch your budget.

Gas cash back programs are relatively simple. Essentially, they work like a rewards program, where you earn points or cash back for every dollar you spend on gas(Our Favorite program refunds you up $2 dollars per gallon ). These programs are typically offered by credit card companies or gas station chains, and they can be a great way to save money over time.

To participate in a gas cash back program, you'll typically need to sign up for a credit card that offers the program. Once you have the card, you can use it to purchase gas at participating gas stations. Depending on the program, you may earn cash back in the form of statement credits, rewards points, or other incentives.

One thing to keep in mind when using gas cash back programs is that they often come with certain restrictions or limitations. For example, you may only earn cash back on certain types of gas purchases, or there may be a limit to how much cash back you can earn in a given period of time. Be sure to carefully read the terms and conditions of any gas cash back program before signing up.

There are several benefits to using gas cash back programs. First and foremost, they can help you save money on a recurring expense. If you're someone who regularly commutes or drives long distances, the savings can really add up over time.

Another benefit of gas cash back programs is that they can be used in conjunction with other rewards programs. For example, many credit cards offer rewards points for every dollar you spend on purchases. By using a gas cash back program in combination with these rewards programs, you can earn even more points or cash back.

Finally, gas cash back programs can be a great way to stay motivated to save money. Knowing that you're earning cash back on every gas purchase can help you feel more in control of your budget and encourage you to spend less in other areas.

Gas cash back programs have become increasingly popular in recent years. According to a survey by CreditCards.com, 68% of Americans say they have a credit card that offers gas rewards. Of those, 29% say they use the rewards frequently, while 39% say they use the rewards occasionally.

Another survey by Bankrate found that the average cash back earned through gas rewards programs is about $107 per year. While this may not seem like a lot, it can make a significant difference for individuals or families on a tight budget.

If you're interested in taking advantage of gas cash back programs, the first step is to find the best program for your needs. There are several factors to consider when choosing a program, including:

- The percentage of cash back or rewards points earned per dollar spent

- Any restrictions or limitations on earning cash back

- Whether the program can be used in conjunction with other rewards programs

- The annual fee, if any, associated with the credit card

To compare different gas cash back programs, you can use online tools like NerdWallet or CreditCards.com. These sites allow you to easily compare different credit cards and their associated rewards programs.

To get the most out of gas cash back programs, it's important to use them strategically. Here are a few tips for maximizing your savings:

- Choose a credit card with a generous rewards program. Look for cards that offer a high percentage of cash back or rewards points for gas purchases.

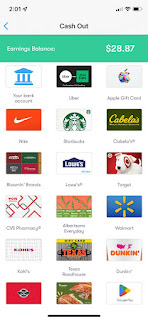

- Use your rewards for other purchases. Many rewards programs allow you to redeem your points or cash back for other purchases, such as travel or merchandise. By using your rewards for these purchases, you can stretch your budget even further.

- Use your gas cash back program in combination with other discounts or coupons. Many gas stations offer discounts or coupons for customers who purchase a certain amount of gas or use a certain credit card. By using your gas cash back program in combination with these discounts, you can save even more money.

While gas cash back programs can be a great way to save money, they aren't the only option. Here are a few other tips for saving money on gas:

- Drive less. If possible, try to walk, bike, or take public transportation instead of driving. Not only will this save you money on gas, but it can also be better for the environment.

- Use gas price comparison apps. Apps like GasBuddy and Waze can help you find the cheapest gas prices in your area, allowing you to save money on every fill-up.

- Keep your car well-maintained. Regular maintenance, such as oil changes and tire rotations, can help improve your car's fuel efficiency and save you money on gas.

To help you find the best gas cash back program for your needs, here are a few reviews of some popular programs:

### Chase Freedom Unlimited

The Chase Freedom Unlimited credit card offers 1.5% cash back on all purchases, including gas. There is no annual fee, and new cardholders can earn a $200 cash back bonus after spending $500 in the first three months.

### Wells Fargo Propel American Express

The Wells Fargo Propel American Express credit card offers 3% cash back on gas purchases, as well as a variety of other rewards. There is no annual fee, and new cardholders can earn a $200 cash back bonus after spending $1,000 in the first three months.

### ExxonMobil Smart Card

The ExxonMobil Smart Card offers 6 cents off per gallon on gas purchases at Exxon and Mobil stations. There is no annual fee, and the card can be used in combination with other rewards programs.

Here are a few common questions about gas cash back programs:

### Are gas cash back programs worth it?

Yes, gas cash back programs can be a great way to save money on gas over time. While the savings may not be huge at any one time, they can add up over the course of a year or more.

### Can I use my gas cash back program at any gas station?

No, gas cash back programs are typically only valid at participating gas stations. Be sure to check the terms and conditions of your program before using it.

### Are there any restrictions on earning cash back?

Yes, many gas cash back programs have restrictions or limitations on earning cash back. For example, you may only earn cash back on certain types of gas purchases, or there may be a limit to how much cash back you can earn in a given period of time.

Gas cash back programs can be a great way to save money on gas and stretch your budget further. By choosing the right credit card and using it strategically, you can earn cash back on every gas purchase and put a little extra money back in your pocket. Whether you're a frequent commuter or simply looking to save money on your weekly fill-ups, gas cash back programs are definitely worth considering. So start shopping around for the best program for your needs, and start enjoying the savings today!

Comments

Post a Comment